CINCINNATI — When the pandemic forced her Kennedy Heights restaurant to close this year, Mary Solomon sought a $50,000 loan through the Paycheck Protection Program. In August, the U.S. Small Business Administration approved her loan.

For $100.

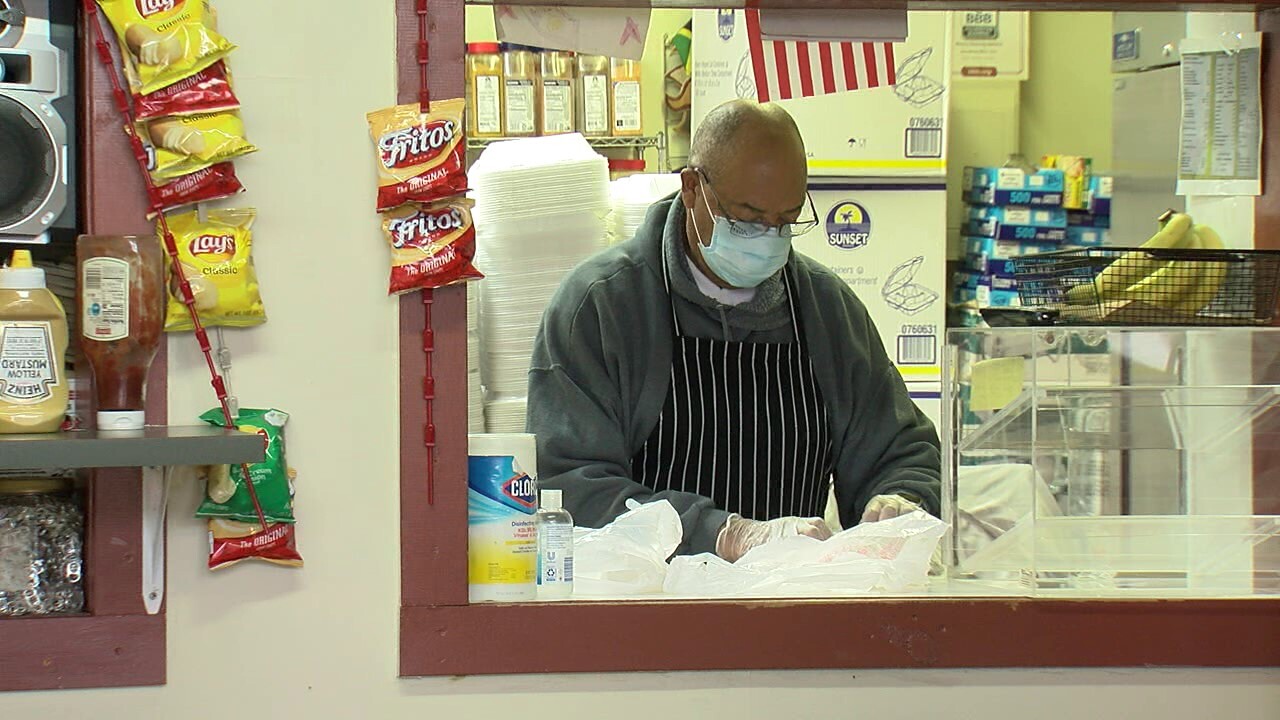

“Ridiculous. What can a hundred dollars do?” said Solomon, owner and sole proprietor of C&M BBQ Grill. But her husband, Cecil, talked her into accepting what turned out to be Greater Cincinnati’s smallest Paycheck Protection loan.

“My grandparents used to tell me that pennies make dollars,” Cecil Solomon said. “I wasn’t passing up or turning down any coins at that time.”

The Solomons weren’t the only business owners to find scant relief from the emergency loan pool created by the CARES Act in response to the COVID-19 pandemic. The WCPO I-Team analyzed more than 30,000 Paycheck Protection loans in the Tri-State and discovered 20% of all borrowers received $10,000 or less, while the top 5% of loan recipients got 56% of the money.

“Unfortunately, it’s a rich get richer and a poor get poorer situation,” said Ryan Burge, an assistant professor of political science at Eastern Illinois University. “By its very nature these programs are going to disadvantage sole proprietorships, small businesses, independent businesses that are not connected to some larger organization.”

Critics of the SBA have complained since April that Paycheck Protection loans were gobbled up by big companies that could have financed their operations in other ways, while the nation’s smallest and most vulnerable businesses struggled to survive.

Burge has studied the Paycheck Protection program and participated in it. He’s a pastor at First Baptist Church in Mt. Vernon, Illinois, which borrowed $6,000 to cover part of its $40,000 budget this year.

Based on his academic research, Burge thinks PPP achieved its main objective: Getting money quickly into the hands of business owners, who delayed -- and in some cases prevented -- layoffs. But he also thinks it incentivized banks to take care of their best customers first, instead of searching for borrowers most endangered by the pandemic.

“I don’t know if I want to criticize Congress too much because they didn’t know what the future looked like,” Burge said. “It was a good idea to try. But again, I think there were problems with it that were not easily solved in such a short period of time.”

Get ready for PPP Round 3

Congress adopted several rule changes that favor small companies when it authorized another $284 billion in Paycheck Protection loans last month. Although the SBA has yet to publish detailed rules, the legislation mandates a $2 million cap on individual borrowers – including those who racked up hefty loan totals by borrowing through multiple subsidiaries last spring.

Among the other rule changes that should favor small companies:

- Congress set aside $25 billion in loans for borrowers with 10 or fewer employees and businesses operating in low- to moderate-income neighborhoods.

- Congress required the SBA to develop “guidance addressing barriers to accessing capital for minority, underserved, veteran, and women-owned business concerns for the purpose of ensuring equitable access to covered loans.”

- Congress authorized “second draw loans” for companies that previously received Paycheck Protection loans but can demonstrate a 25% reduction in revenue for any quarter in 2020.

- Congress sweetened the pot for restaurants and hotels, which can now borrow up to 3.5 times their monthly payroll – up from 2.5 in earlier Paycheck Protection loans.

But those changes may not be enough to help borrowers like the Solomons, who had fewer than five employees prior to the pandemic and operated on a bare-bones staff for most of 2020.

“I’m not greedy. I’ll take $50,000,” Mary Solomon said. “I need a hood. I need a stove right now, so I’m satisfied with $50,000, just to get something started somewhere, somehow.”

Solomon was born in Jamaica and moved to Cincinnati in 1983, raising twin sons with her husband, Cecil, who is the "C" in C&M BBQ. Launched six years ago, the Caribbean-themed restaurant employed mostly family members before March 15, when Ohio ordered bars and restaurants to close. It survived on delivery and carry-out orders after May 15, when Ohio restaurants were allowed to re-open.

Cecil Solomon said he applied not only for a Paycheck Protection loan but also an Economic Injury Disaster Loan, which was authorized by the CARES Act to distribute loans and grants to small businesses impacted by COVID-19.

“I applied for everything out there,” he said. “I mean everything.”

Solomon said he never got a response from Fifth Third Bank. So, in August he applied through another lender, CRF Small Business Loan Company LLC. On Aug. 7, he said CRF told him he qualified for $100, based on "Schedule C" disclosures on his tax return, which detail business profits and wage expenses for sole proprietors. Although both were disappointed by the offer, Cecil convinced Mary Solomon to accept the loan.

“It took me a week of putting in apps, supplying documentation, just to qualify for that $100,” Cecil Solomon said. “She said, ‘You can tell them to keep that.’ I said, ‘No baby, a hundred is a hundred.’”

Loan clusters drove PPP funds to big borrowers

The WCPO 9 I-Team has been tracking federal stimulus spending for months to see what impact the Coronavirus Aid, Relief and Economic Security (CARES) Act had on the Tri-State economy in 2020. We discovered fraud and overpayment problems in Ohio’s distribution of Pandemic Unemployment Assistance, while documenting a huge backlog of PUA claims in Kentucky. Our prior coverage of PPP loans showed minority-owned firms had a tough time securing small-business relief while some PPP borrowers actually cut jobs after taking loans intended to keep people working.

The SBA released new details on PPP loans Dec. 3, after it was sued by media organizations under the Freedom of Information Act for not identifying the names of borrowers approved for loans of less than $150,000 and not providing exact loan amounts for those borrowing more than $150,000. The new data gives a much more complete picture of where PPP loans went – and where they didn’t.

Solomon’s restaurant is in the 45213 zip code, which received 150 loans for a total of $19 million. The Blue Ash zip code, 45242, got 1,074 loans totaling $219 million.

The new SBA data also makes it possible to see how loans were clustered by address and business ownership. For example, 4503 Marburg Ave. is home to the largest Planet Fitness location in the Tri-State. But it’s also the corporate headquarters of Planet Fitness Midwest LLC, which secured 35 PPP loans totaling $2.4 million through Fifth Third Bank, according to SBA records.

Planet Fitness is a publicly traded company with a market value of $6.7 billion, but its Cincinnati franchise is a small business, said Mike Hamilton, chief operating officer and partner in Planet Fitness Midwest. Hamilton said most of its 42 gyms were closed for about 90 days this year due to government-imposed shutdowns. One of its Pennsylvania locations is still closed. But the company’s 750-employee workforce remained intact despite the pandemic.

“I have no shame in the loans we took and how we used the money,” said Mike Hamilton, chief operating officer and partner in the Planet Fitness Midwest. “We’re taking a relatively small amount of money for each of these businesses and using it as designated, to pay our employees that were home not working when we had no revenue to keep them working.”

Archways Bluegrass LLC is a McDonald’s franchise operator that shares an address with a McDonald’s restaurant at 10063 Dixie Highway in Florence. And so do 21 other restaurants owned by the Groen family, which qualified for 33 loans worth $6.7 million for McDonald’s locations in Ohio, Kentucky and Indiana, SBA records show.

Another loan cluster can be found at 100 E. Rivercenter Blvd., a Covington office complex built by Corporex Cos. Inc. Records show tenants of the two riverfront towers were approved for 14 loans totaling $11.1 million, including a $7.5 million loan for CTI Clinical Trial Services Inc. and 11 loans totaling $3 million for corporate affiliates of Corporex.

But the region's biggest loan cluster by far belonged to Columbia Sussex Corp., a Northern Kentucky hotel chain that was the subject of an I-Team report in July. It showed the Crestview Hills-based company, which owns more than 50 hotels in 22 states, was approved for more than $29 million in PPP loans. But the SBA data available at that time did not include the exact loan amounts for 17 Columbia Sussex affiliates that were publicly disclosed at that time and it didn’t name three other limited-liability companies that borrowed less than $150,000 each. The new SBA data shows Columbia Sussex affiliates were approved for 20 loans totaling $49.8 million.

“That’s ridiculous, for one business,” Mary Solomon said.

“I’m not knocking anybody who got serious funding,” said Solomon’s husband Cecil. “I’m happy for ‘em, as a matter of fact. But I just think there’s an imbalance in the system.”

The I-Team attempted to reach Columbia Sussex, Corporex and Archways Bluegrass, but our calls were not returned.

Church chat

Because every borrower is named and every loan amount specified in the new SBA data, it’s possible for the first time to quantify all loans approved for large organizations, even those that are loosely connected, like the Roman Catholic church. The I-Team searched local SBA records for all loans received by religious organizations and private schools for elementary and high school students. That led to a list of 690 loans totaling $107.7 million, 48% of which went to Catholic churches and schools.

“This loan was really a great safety net,” said Tim Reilly, president of St. Xavier High School, which borrowed $3.8 million to preserve 295 jobs. “We’re spending a lot on our program here and there is no way we wanted to compromise our program if we didn’t have to.”

Catholic schools, parishes and charities were approved for 109 PPP loans, ranging in size from the $10 million borrowed by the Diocese of Covington to the $1,200 received by St. John the Baptist Catholic Church in Osgood, Ind. The I-Team’s analysis shows Catholic organizations received about 10 times more than Baptist organizations in the Tri-State and four times more than the combined total for Methodist, Jewish, Presbyterian, Episcopal, Lutheran, Islamic and Hindu congregations.

Although critics nationwide have questioned whether the church made too much use of the program, Reilly said Catholic loan volume in Cincinnati was mostly about employment.

“To me this wasn’t about whether you’re faith-based or not,” Reilly said. “It’s whether you are an organization that people depend on for income. A lot of the other faith-based organizations aren’t trying to operate a school or daycare or soup kitchen or a hospital. So, I think the number of people who depend on a Catholic organization for a paycheck is really what that reflects.”

Burge, the political scientist and assistant professor from Eastern Illinois University, published research in July showing at least 11,500 Christian organizations received PPP funding nationwide, including about 2,200 Catholic churches and schools. So, he was not surprised that Catholic churches were more prolific users of the PPP program than other denominations here in Cincinnati.

“They have employees, too,” Burge said. “Just because they’re religious employees doesn’t mean they should be discriminated against.”

Catholic high schools and parishes with large elementary schools were among the biggest faith-based borrowers, which Burge said critics of the church rarely acknowledge in media accounts about PPP loans.

“I think most people would be much more willing to see the money going to teachers in a Catholic school as opposed to the priests and the pastors,” Burge said. “That’s a part of the narrative that’s unexplored.”

Wisdom of Solomons

Another unexplored narrative is the extent to which small businesses are surviving from indirect support from the Paycheck Protection Program. The Solomons are a case in point. They could have thrown in the towel when their quest for a life-saving loan turned up a paltry $100. But instead they found another lifeline in the COVID-19 Comfort Meal program, launched in April by the Council on Aging of Southwest Ohio. C&M BBQ is one of 9 local restaurants chosen to deliver 47,000 meals to 78 local apartment buildings for low-income seniors.

Cecil Solomon credits his former boss at Cincinnati Area Senior Services with connecting him to the program, which generated enough new orders to replace most of the revenue his restaurant lost in the pandemic. Solomon worked as a bus driver for CASS, a large Meals on Wheels provider for COA. Both received Paycheck Protection loans totaling $4.7 million.

“God is large and in charge and he looks out for his own,” Cecil Solomon concluded, and Mary concurred: “We all have to thank God we’re still alive, we’re still here. That’s how I look at it.”