CINCINNATI — Less than a month after buying the office and retail portions of Carew Tower for $18 million, real estate investor Anoop Dave has filed a $5.1 million lien against Cincinnati Netherland Hotel LLC for “unpaid expenses” owed to the Carew Tower Condominium Association.

The lien, filed with the Hamilton County Recorder on Sept. 9, says the money is owed from a $12.5 million special assessment to all three condominium units that were created when the iconic Cincinnati building was split into three ownership parcels in 2017. Liens totaling $11.5 million were filed against all three entities by the condo association board, which Dave now serves as president. Thus, in effect, Dave filed two of the three liens against himself.

Cincinnati Netherland owner Greg Power said the hotel lien is not a big deal. It’s merely intended to cover the cost of exterior renovations as required by the city of Cincinnati’s façade program. Power, who sold Carew Tower's office and retail space to settle a foreclosure case, said the special assessment was created at closing when the property was sold Aug. 18. He plans to pay for facade expenses as repairs are made in the next three to four years.

“They’re going to be doing a lot of tuck pointing on the building. That’s all this is,” Power said. “The hotel’s doing great … everything’s fine there.”

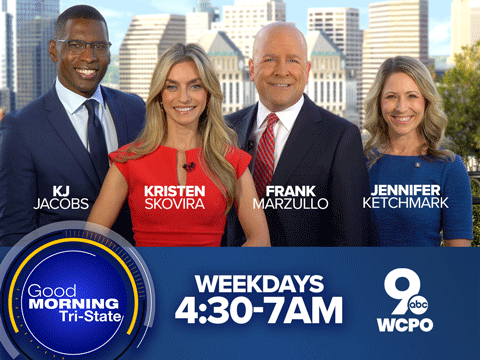

The Hilton Cincinnati Netherland Plaza is downtown’s largest convention hotel, with 561 rooms operated by Crescent Hotels & Resorts of Fairfax, Va. WCPO tried to reach Crescent Hotels and Dave, CEO of New York-based Victrix Investments. Neither responded.

But an attorney who worked for the prior owners of Carew Tower said the lien, combined with the building’s recent sale after a foreclosure filing, make him worried about the building’s future.

“It’s hard to tell from this mixture of things whether this is really a problem or simply an action taken to provide some additional protection by the new owner of the tower,” said Tim Burke, a partner in the Manley Burke law firm. “It wasn’t too long ago when the electricity to the complex almost got shut off. So, we don’t know how much of a problem there is. Hopefully, the new owners are in a far better position to address some of these issues than Mr. Power was.”

Carew Tower is one of Cincinnati’s most important buildings. Constructed over 13 months at the start of the Great Depression, it rises 570 feet above sea level and was Cincinnati’s tallest building until Great American Tower bested it by 91 feet in 2011. It was placed on the National Register for Historic Places in 1982 and is known for its art deco design elements, custom-made Rookwood tile in its first-floor arcade and a rooftop observation deck that offered unmatched views for decades.

While other aging downtown office properties converted to hotel and residential uses in the last decade, the much larger Carew Tower complex has struggled to make the conversion. Luxury real estate specialist Lee Robinson said he reviewed plans to replace office space with residential condos a few years ago. He advised against it.

“There’s two major challenges in the ownership world,” said Robinson, owner of Robinson Sotheby’s International Realty. “One is the parking. The other is outdoor space.”

But Robinson thinks the property would work as an apartment building because renters have less of an expectation for dedicated parking spaces and outdoor decks. He added the building’s floor plates lend itself to rental units with lots of windows.

“People want light and they want views and obviously the Carew Tower is exceptional in that regard,” he said.

Dave hasn’t publicly announced his plan for Carew Tower, but attorneys from the Wood Herron & Evans law firm, which left Carew Tower at the end of August, told WCPO an apartment conversion is in the works. Victrix Investments is already pursuing an apartment conversion at the former Macy’s headquarters building on 7th Street.

Carew Tower's new ownership structure could make the building’s redevelopment more complicated because it requires the cooperation of two owners — Power’s hotel company and 441 Vine Street Owner LLC, a corporate affiliate of Victrix Investments.

Carew Tower’s new deed — filed the same day the building was sold — says its mechanical, electrical and plumbing systems are “currently anticipated” for separation, meaning the hotel will have different heating, cooling and utility systems than the office and commercial space. The deed also gives the condo association “the authority to levy special assessments necessary to perform critical repairs,” with all disputes between the building’s two owners to be settled by arbitration.

“It creates complexity that wouldn’t be there with a single owner,” Burke said. “Whether it makes it more difficult or not remains to be seen as to how those owners cooperate with one another.”

In the meantime, Burke sees potential difficulties ahead for the hotel property. Like all hotels, it suffered through the pandemic. And it owes $45.5 million on a 2019 mortgage that matures in 2024, according to securities filings for the Benchmark 2019-B14 Mortgage Trust. The loan’s scheduled principal amount is $3.4 million more than the Hamilton County Auditor’s current appraisal value for the property.

Power said he is working to refinance the mortgage and has a good working relationship with the office building’s new owner.

“I certainly hope it can survive,” Burke said. “It’s such a wonderful part of our landscape, our history and there’s not another hotel like Netherland in Cincinnati.”