CINCINNATI — Kathy Schwartz felt the impact when Sears closed its Northgate Mall store in 2018. Revenue plunged 25 percent the following year at Kathy’s Happy Organs and Pianos, a Northgate tenant for 18 years.

Schwartz is a cancer survivor who pulled her store through the 2008 recession and outlasted a former landlord who jacked up rents in the early 2000s. But now Macy’s is closing its Northgate store, leaving the mall with no department store anchors.

“Will I be here in five years? I don’t know if I’m going to be here tomorrow,” she said. “We’re all on a banana peel.”

Cincinnati-area malls took a sharp turn for the worse in 2019, as retail closures piled up and shoppers increasingly bypassed brick-and-mortar stores for bargains online or on their phones.

The I-Team spent the last month researching local shopping centers, interviewing mall owners, brokers and local government officials. We gathered data on vacancy rates and sales performance from public filings required by lenders and the U.S. Securities and Exchange Commission. We also walked through six local malls and mapped every vacant space to determine which properties are the most endangered.

Two things quickly became apparent: Malls typically ranked below open-air shopping centers in key financial metrics and some indoor properties have alarmingly high vacancy rates. Throughout this story you’ll find details on 14 local shopping centers, including six malls that we've ranked from most to least endangered.

Bottom line: Some local malls will not survive this decade.

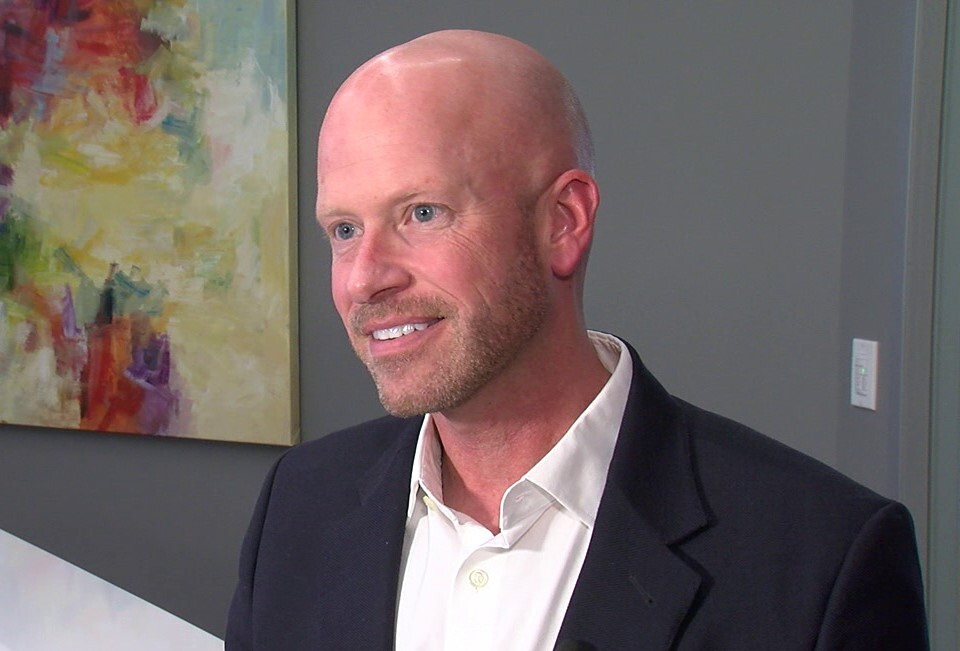

“Five years from now, yes. Ten years from now, not certain,” said Terry Ohnmeis, director of retail services for the brokerage firm Cushman & Wakefield. “There’s no way that all of them will be interior malls at that point in that way that we know it today. But they’ll probably still be a destination for us to go shop. It’s just the way in which we shop is going to evolve quickly.”

The national picture

It isn't just online shopping that's putting malls in peril. It's also the way in which shoppers shifted away from the mall for lower prices and more convenience. It started decades ago with discounters, big box stores and wholesale chains. And it continues with Amazon.

U.S. retailers have closed more than 24,000 stores since 2017, according to a November report by CoStar, a real estate research firm based in Washington, D.C. In the last two years, CoStar said department stores and apparel sellers dominated the list of closures. Traditional malls rely heavily on both categories.

A "substantial share" of 2019 closures happened because smaller stores took advantage of lease language that lets them leave a mall "when anchor tenants move out," said the report. “Others simply fell prey to the ongoing shifts in the retail market, such as competition from e-commerce, oversupply and high levels of burdensome debt.”

Macy’s Inc. cited declining sales in weaker malls as the main factor in its decision to close 125 of its “neighborhood stores” in the next three years. Northgate is one of 29 closures already announced, with 96 more to come. Procter & Gamble Co. cited “significant declines in shopping mall traffic” in its recent decision to close some of its Art of Shaving stores. P&G hasn’t said how many of its roughly 70 stores will close or whether the list includes two local stores at Kenwood Towne Centre and Liberty Center.

Big box stores and warehouse clubs like Costco and Sam’s have also robbed malls of market share. So have open-air lifestyle centers that combine restaurants and retail with other real estate uses, including apartments, hotels, office space and health care.

Shopping center expert Nick Egelanian argues most cities will eventually have only one traditional mall and ownership of these properties will be consolidated by the nation’s biggest mall operators, including Brookfield Property REIT Inc., owner of Cincinnati's least endangered mall, Kenwood Towne Centre.

“The malls that will survive are the ones that will have the highest-end merchandise, best-in-class merchandise in their markets and actually will have sales well over a thousand dollars a square foot,” said Egelanian, president of SiteWorks in Baltimore, Maryland. “Kenwood is the dominant mall in Cincinnati. Kenwood has all the ingredients to be a survivor long term. It has been invested in. It will continue to be invested in. And it’s best in class in the market.”

The local picture

The I-Team collected as much financial data as we could find on the region's 14 biggest shopping centers, including six malls and five open-air community centers like Rookwood Commons, Bridgewater Falls and Crestview Hills Town Center. Malls tend to rank lower than community centers on financial metrics, but Kenwood is an exception:

- Kenwood ranked at the top of a list of eight local retail centers in total revenue, based on reports provided to the I-Team by the research firm, Trepp. Shopping centers often borrow money in Commercial Mortgage Backed Securities deals, which require regular updates to bond investors on the financial condition of the property that secures the debt. Trepp pulls this financial data from public reports and makes it available to investors and the media. The most recent report on Kenwood Towne Centre showed the 756,412-square-foot portion of the mall that’s pledged as collateral to the debt generated $47.6 million in 2018 revenue, or $62.92 per square foot. That’s more than twice the average of seven other local properties, based on Trepp reports dating back to 2008.

- Kenwood ranked first among malls and third among all retail centers in WCPO's analysis when it comes to occupancy rates, as disclosed by property owners in their SEC filings. The top-ranked property, Buttermilk Town Center in Crescent Springs, was 100 percent full in 2018, according to the annual report filed last February by RPT Realty Inc. Kenwood's occupancy rate was 96.5 percent.

- Kenwood is by far the region’s strongest mall in a Cincinnati “market snapshot” provided to the I-Team by Green Street Advisors, a Newport Beach, California-based real estate consulting firm. The report was provided “for background purposes” on the condition that we would not share specific data. However, Green Street confirmed that its estimate for Eastgate Mall matches the $330 per square foot that CBL Properties Inc. disclosed to investors in its 2018 annual report. It also confirmed that Eastgate ranks in the middle of the pack on this metric among Cincinnati-area malls.

The I-Team also looked at median household income in the zip codes where 14 local shopping centers are located to get a rough idea of the relative wealth surrounding each property. Although retail centers draw from much larger territories than the zip code surrounding them, it’s interesting to note that the region’s six malls all rank at the bottom in this comparison, even Kenwood. Egelanian said that probably has more to do with when those malls were built than how strong their target marketing areas are.

“The two strongest sub markets for discretionary spending in Cincinnati will stay for a long time Rookwood and Kenwood,” Egelanian said. “They share one thing in common. Very densely populated on a terrific highway system with great incomes all around them and a very difficult environment in which to create competition.”

View from the mall

Because it’s hard to find comparable numbers on all local malls, the I-Team supplemented its data with observations by mall owners, retail experts and site visits to each local property. That’s where the impact of retail vacancies is most apparent.

“I was taken aback a bit by the amount of vacancies,” said Andy Kuchta, economic development director for the city of Springdale. He shopped at Tri-County Mall over the holidays because he knew it would be a project he might pursue after joining the city in January.

Tri-County ranked fifth out of six malls in the I-Team's analysis, meaning it's the second-most endangered property. It's spiraling downward after losing its Sears store in 2018 and closing its food court last summer. General Manager Renee Bell left the property last February and hasn’t been replaced. Ethan Allen, Charlotte Russe, Torrid and Spencer’s all left or announced plans to leave the region’s largest mall in the last 12 months.

“I don’t think anybody here at the city believes this property can be brought back as a traditional mall,” Kuchta said. “Everybody understands that society has changed, shopping habits have changed. And it is going to be something different.”

Kuchta said the city was told by the mall’s leasing firm last year that residential developers were interested in a $40 million project to bring up to 400 high-end apartments to the site. He’s yet to discuss that opportunity with SingHaiyi Group, the mall’s Singapore-based owner. But in the meantime, Springdale is exploring the creation of a Designated Outdoor Refreshment Area to encourage mixed-use development on the site. That's an entertainment district where patrons can consume alcohol outdoors. It's enabled by state legislation approved in 2017.

SingHaiyi officials declined to be interviewed. Although it has floated proposals for a hotel and dine-in movie theater in the past, the company indicates no major changes are currently planned in a statement to the I-Team.

“Careful considerations and prudent management form the bedrock of our business decisions,” it said. “While we have had redevelopment plans in place, it did not come to fruition due to challenges arising from the impact of e-commerce on the US brick-and-mortar retailers. As a result, we need to fine tune the tenant mix of the mall to make it a sustainable one.”

Mall owners have deployed a variety of strategies to keep their properties viable, including the development of new retail space in parking lots, adding restaurants and entertainment-oriented tenants and demolishing or converting empty department stores into specialty retail.

“There’s not a single landlord that’s asleep at the wheel,” said Ohnmeis, who recently signed three tenants – Old Navy, Ulta and Spectrum – for two new buildings that will replace a former Sears store at Western Hills Plaza in Westwood.

Northgate accomplished the same feat by bringing XScape Cinemas to a former JC Penney space and filling a former Dillard’s store with several specialty retailers, including DSW, Marshall’s, Ulta and Burlington.

“It’s a great strategy,” Ohnmeis said. “The size that retailers take now is smaller. It’s more specialized. So, the best way to pull those tenants in is to chop that up into various spaces like they did with the Dillard’s box.”

But there are some limits. Ohnmeis said it works best when the converted anchor space faces a busy street. Most of Northgate’s anchor space faces away from Colerain Avenue. Mall owners can also be hamstrung by space that’s owned by an anchor in bankruptcy. That’s the case with Sears stores in Northgate, Florence and Eastgate.

“If an anchor falls into bankruptcy, it’s tied up and the mall owner can’t do a lot about that until its resolved,” he said.

Northgate tenant Schwartz said she was encouraged last summer when Colerain Township pushed for Northgate to become a lifestyle center, with portions of the mall demolished to make way for new streetscapes that could embrace housing, service retail and other uses.

“By the time they get the permissions and get the plans done, all of that, it’s gonna be a while," she said. "Its going to be a hard couple of years.”

Northgate Mall’s owner, the Dallas, Texas-based Tabani Group, did not respond to the I-Team’s requests for interviews. The mall ranked fourth in the I-Team's analysis, ahead of Tri-County, because it's been able to retain national tenants despite the loss of department store anchors.

The region's most endangered property is Towne Mall Galleria in Middletown. Owner George Ragheb said he and two partners have invested more than $13 million to attract new tenants to the property. A Chipotle restaurant is currently under development, while Planet Fitness, opened in 2016, is the mall’s biggest tenant. Burlington Coat Factory and Gabe’s claimed parts of a former Dillard’s store.

But the mall’s interior space is mostly vacant seven years after Ragheb made his first investment there. He said he rejected offers for more discount retail and a self-storage facility because he wants to turn the property into something Middletown can be proud to call its own.

“You’ve got an entertainment option; those opportunities are endless,” he said. “You can demolish the mall building and have sophisticated electric kart racing tracks that will bring a lot of youth, a lot of families in the area. You can bring in a bowling alley or a movie theater.”

Residential development is another option, Ragheb added, although no deals are pending.

“They built a few years back about 250 apartments fairly close to us and they leased out fairly quickly,” he said. “So, demolish the mall. Build an apartment community. It will do fantastic.”

Eastgate Mall, which ranks third in the I-Team's analysis, has tapped entertainment users like Glow Golf and Discovery Zone to fill more than 13 percent of its leasable space. But the mall has other big tenants, including H&M and Shoe Dept, each occupying more than 18,000 square feet. Until Sears closed in December, Eastgate was the only local mall with four department store anchors. Securities filings indicate the mall has a balloon payment due in April on a $30.1 million loan with an outstanding balance of $24.4 million.

In a note to bond investors, the Kroll Bond Rating Agency said Eastgate Mall owner CBL Properties has a history of "disposing of underperforming assets." It added that the mall's net cash flow and sales per square foot have declined in recent years. CBL Properites provided written responses to the I-Team’s questions but didn’t address whether these factors will impact the property in the future.

“As consumer preferences shift, we are constantly looking for ways to bring in new and diverse uses to our properties,” spokeswoman Stacey Keating wrote. “We will continue to pursue opportunities to add new retailers, restaurants and experiences.”

That brings us to the second-ranked mall in the I-Team's analysis: Florence Mall. It still has a healthy supply of national retail tenants, including some that other malls have lost, like Forever 21 and Abercrombie & Fitch. And it's using pop-up stores and signage to enliven its empty space, which is concentrated near a former Sears store that closed in 2018.

Ohnmeis said the mall has geographic advantages over its Ohio rivals, which are crowding each other out to serve fast-growing suburbs between Cincinnati and Dayton.

“Florence is a dynamite corridor that captures not just 10 miles away but really 45 miles away,” Ohnmeis said. “It funnels all of the distance between Cincinnati and Louisville into the Florence market. And then it’s also strong for daily needs shopping with a Kroger right across the street that has repeat visits all the time.”

But the mall is not without risk, according to a Jan. 20 report by the Kroll Bond Rating Agency. It placed an "underperform" rating on a $90 million loan that requires interest-only payments before it's paid off in 2022.

“KBRA maintains KPO of underperform for this loan due to the closure of Sears in November 2018,” said the commentary. “In addition, we remain concerned with future performance due to the collateral’s exposure to several struggling retailers, including Macy’s and JC Penney.”

What about Liberty Center?

So, there you have it. Cincinnati’s surviving mall inventory includes two properties – Kenwood and Florence – in good to great shape. Two more – Eastgate and Northgate – are showing cause for concern. Finally, there are two properties on life support: Tri-County and Towne Mall in Middletown.

There are also two giant shopping centers not included in this analysis: Liberty Center and the former Forest Fair Mall. Now known as Forest Fair Village, the 90-acre megamall complex hasn't functioned as a mall for more than a decade. Although Kohl's and Bass Pro Shops remain on the property, its owner has been marketing the place to non-retail users since 2017.

Liberty Center was not included in the mall comparisons because it's a lifestyle center. But it's worth exploring briefly because its mixed-use format is what many local mall owners are working to adopt. Plus, it definitely has some mall-like tendencies, with its foundry building anchored by Dillard’s and the region’s largest Dick’s Sporting Goods, flanked by a two-story indoor concourse with a food court. And here’s another similarity: Just like malls, it’s struggling to fill space.

“The center remains at an occupancy in the low 80 percent range, reflecting the balance between new tenants, which are predominantly food, entertainment or experience related, with continued challenges in retaining traditional soft goods retailers whose business models are changing rapidly,” said Stuart Rothstein, CEO of Apollo Commercial Real Estate Finance Inc., Liberty Center’s biggest lender.

The company has written off $47 million in debt on the Butler County project and twice replaced its leasing team to improve its prospects of recovering the $126 million still owed.

“The management team in this center has done a commendable job managing and optimizing costs as well as strengthening the center's presence in and relationship with the surrounding community,” Rothstein told investors in October. “We continue to view this center as being well located in a market that continues to see both business and residential growth.”

Ohnmeis said Liberty Center’s location and the fact that it already has office, residential and hotel users in place, should make it easier for the project to adapt by filling empty retail space with other kinds of real estate. That’s also something all malls will have to do in the years ahead.

“By no means are they dead,” Ohnmeis said. “They’re probably going to be smaller. There’s going to be fewer of them for sure as we’ve already seen. But a lot of the ones that were struggling the most are already gone. You’ve already seen the major hits in that market. Now you’re just seeing it evolve as retail continues to shift.”