CINCINNATI — The Kroger Co. achieved over $1 billion in cost savings last year, money that it’s reinvesting in store remodels, price reductions and new ways to boost online sales.

Some shareholders are worried that cost cutting has started to impact the quality of the shopping experience at Kroger.

“There’s only so many areas where you can cut costs before you skeletonize the store,” said Rich Cagney of Lancaster, who retired from Kroger in 2001 after 33 years. “In the store that I worked in, I can walk around that whole store and only see a few clerks during the day.”

Cagney was one of two shareholders who criticized the in-store shopping experience at Kroger’s annual meeting last week. He said customers want store employees who can answer their questions instead of self-serve attendants.

"They don’t want to go to Meijer’s where they have 25 cash registers and three cashiers and no baggers or Walmart where it looks like you’re going into a circus,” Cagney told CEO Rodney McMullen.

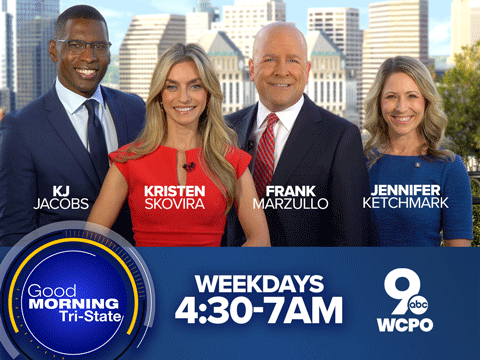

Shareholder Vic Ellison questioned whether Kroger’s increasing emphasis on digital sales is negatively impacting its brick-and-mortar locations.

“I’m just so worried that we forgot the fundamentals,” Ellison said. “In the store, we’re worried about checking people out. We don’t worry about filling the grocery shelves.”

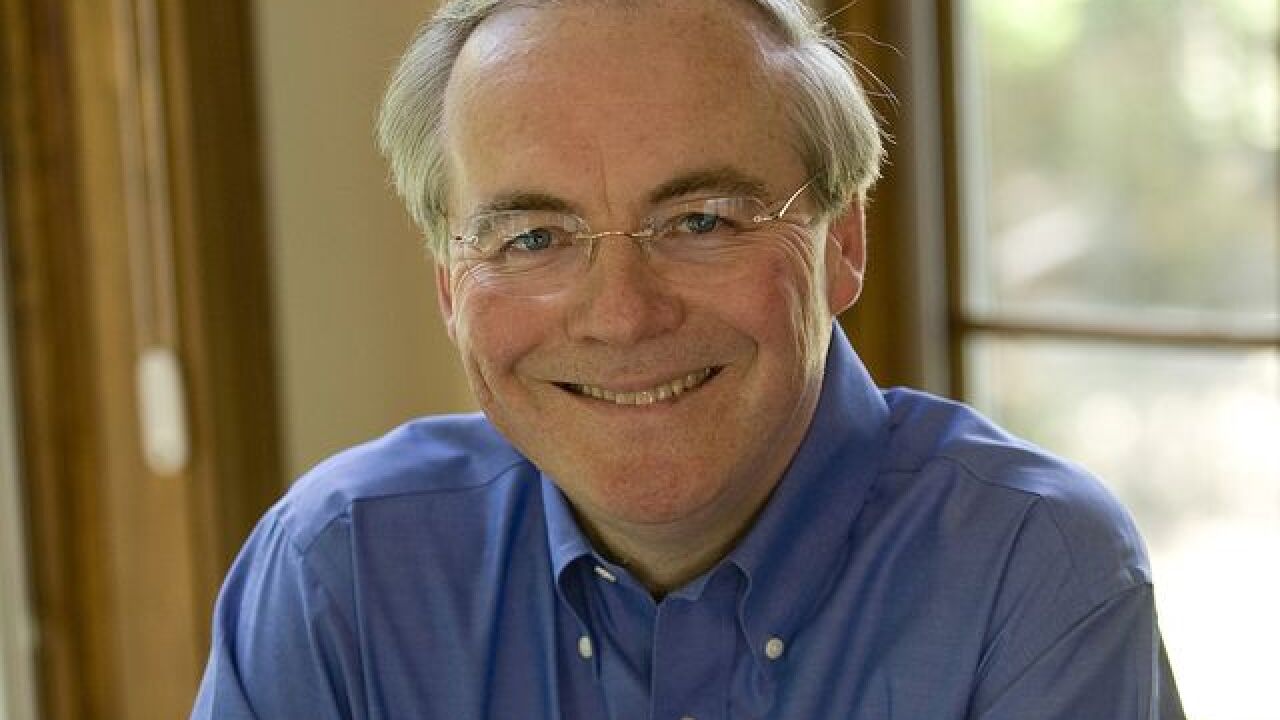

In an interview after the meeting, McMullen said the company is cutting costs “through process change and goods not for re-sale. So, it’s figuring out how to buy bags cheaper or paper bags cheaper. The customer experience, we’ve actually invested more labor hours than we did a year ago … What we’re doing is saving where we can save it so we can invest it where we need to invest it. But actually our average number of hours in our store is higher than a year ago.”

McMullen said Kroger collects hundreds of thousands of “feedback points” every day from the 11 million people that shop in its stores. He has access to that feedback on his phone and he checks it regularly.

“We look at that every day to say, ‘What’s the customer telling us on produce and meat and our friendliness, our in-stock?’ All of those things we are making progress on,” McMullen said. “Don’t take my comments to say that we’re satisfied because we’re never going to be satisfied. But I can pull out my phone right now and show you customers that weren’t satisfied about something and I can give you an equal number where it’s like, ‘You guys are amazing.’ We take every feedback personally.”

Kroger’s stock is down 21 percent year to date, closing Friday at $21.71 per share. Analysts have been fretting about whether Kroger can deliver on the promises of its ambitious Restock Kroger program, announced in 2017. It’s a package of 11 different initiatives aimed at boosting operating profits by $400 million to $3.5 billion by 2020.

McMullen said the company is “right on target” with its Restock Kroger goals, including the development of “alternative profit streams” from advertising, credit cards and investments in new consumer-product companies. This segment is expected to grow revenue by $100 million this year, although Kroger has yet to reveal much detail about where the growth is strongest and how much total revenue it generates in this segment.

In his speech to shareholders, McMullen highlighted other Restock Kroger achievements:

- Digital sales have climbed from zero in 2014 to a “run rate” of $5 billion by the end of last year.

- Kroger’s Simple Truth line of organic products didn’t exist six years ago. Now it’s the largest organic brand in the country with $2.3 billion in sales.

- More than 2,500 Kroger employees have signed up for a new educational benefit. Eighty percent of them are store associates, pursuing everything from high-school equivalency diplomas to PhDs.

- To reduce the use of plastic, Kroger signed an exclusive partnership with Loop, which offers more than 100 consumer products in re-usable containers. The two companies are testing a grocery format for the product on the east coast.

“Kroger is transitioning from a grocery company to a growth company from physical to omni-channel and we are partnering with the world's best innovators to accelerate this transformation,” McMullen said. “I've never been more confident in Kroger's future.”