CINCINNATI — The Kroger Co. and Albertsons grocery chain have agreed to sell more stores and “additional non-store assets” in an attempt to satisfy antitrust regulators.

The updated plan calls for C&S Wholesale Grocers to purchase 166 more stores than previously announced, bringing the total to 579 stores.

It also adds the Haggen retail banner, two private-label brands, a dairy facility and “increased distribution capacity” to the list of assets Kroger and Albertsons will sell to C&S if their deal survives antitrust scrutiny.

Kroger has been working since October 2022 to pull off a $24.6 billion acquisition of its largest supermarket rival.

After more than a year of research, the Federal Trade Commission sued to block the merger in February, claiming it will lead to higher prices and reduced bargaining power for labor unions. The FTC also objected to the companies’ plan to mitigate damage by selling 413 stores to C&S, the nation’s 8th largest privately owned company with annual sales of more than $34 billion, according to Forbes.

“Divesting these individual assets to a grocery wholesaler with limited experience operating retail supermarkets will fail to mitigate the substantial harm to consumers and workers from lost competition between Kroger and Albertsons,” said the FTC complaint. “C&S would be acquiring a patchwork of assets cobbled together by Kroger’s antitrust lawyers, not a standalone business likely to succeed.”

The latest divestiture plan addresses that criticism by providing more distribution capacity to C&S through “a combination of different and larger facilities as well as expanded transition services agreements to support C&S,” according to a Kroger press release. It also “expands the corporate and office infrastructure provided to C&S given the increased store set to ensure C&S can continue to operate the divested stores competitively and cohesively.”

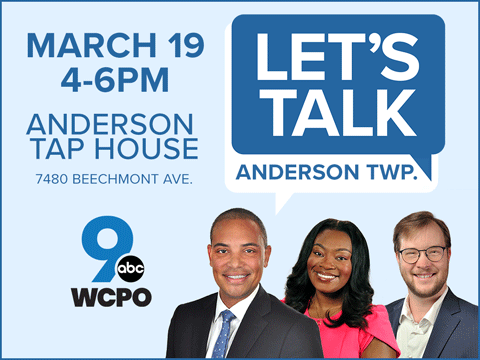

Two experts told WCPO they don’t expect the FTC to back down in its attempt to block the Kroger-Albertsons merger. But the companies might be trying to influence the litigation that will heat up this summer in Oregon, Colorado and Washington, D.C.

“When they go to court, they can tell the judge, ‘Look, we had this divestiture deal. The FTC pushed back on it. We responded to that pushback. And so this is as good a deal as we could come up with and still have the merger work,’” said Eric Fruits, a senior scholar who has followed the Kroger-Albertsons merger for the International Center for Law and Economics in Portland.

Kroger’s strategy could work, said Columbus attorney Morgan Harper, director of policy and advocacy for the American Economic Liberties Project.

“I don’t see these divestitures as being enough to convince a court,” Harper said. “But we are in uncharted territory in certain ways, in terms of the understanding of antitrust law and how our antitrust law matches to the realities of the modern economy. So, the ultimate decision on that front will rest with the judge who has been assigned to this case.”

States that either sued Kroger separately or joined the FTC’s lawsuit against the deal saw some of the biggest changes in the new divestiture plan. Arizona went from 24 divested stores to 101, while Colorado jumped from 52 to 61 divested stores.

Here is a list of stores being considered for sale:

- Washington: 124 Albertsons Cos. and Kroger stores

- California: 63 Albertsons Cos. stores

- Colorado: 91 Albertsons Cos. stores

- Oregon: 62 Albertsons Cos. and Kroger stores

- Texas/Lousiana: 30 Albertsons Cos. stores

- Arizona: 101 Albertsons Cos. stores

- NEvada: 16 Albertsons Cos. stores

- Illinois: 35 Albertsons Cos. and Kroger stores

- Alaska: 18 Albertsons Cos. stores

- Idaho: 10 Albertsons Cos. stores

- New Mexico: 9 Albertsons Cos. stores

- Montana/Utah/Wyoming: 11 Albertsons Cos. stores

- DC/Maryland/Virginia/Delaware: 9 Harris Teeter stores

“The companies believe the amended divestiture package will bolster their position in regulatory challenges to the proposed merger, including pending court proceedings,” said a Kroger press release.

"Importantly, the updated divestiture plan continues to ensure no stores will close as a result of the merger and that all frontline associates will remain employed, all existing collective bargaining agreements will continue, and associates will continue to receive industry-leading health care and pension benefits alongside bargained-for wages,” Kroger CEO Rodney McMullen said in the Kroger release. “Our proposed merger with Albertsons will bring lower prices and more choices to more customers and secure the long-term future of unionized grocery jobs."